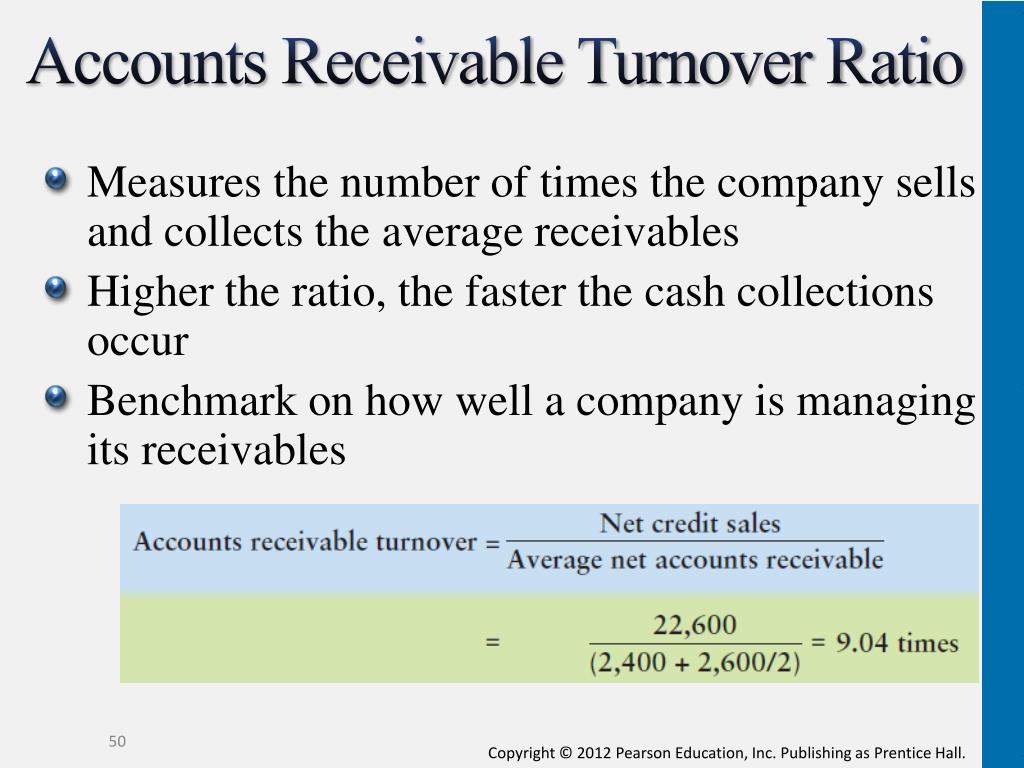

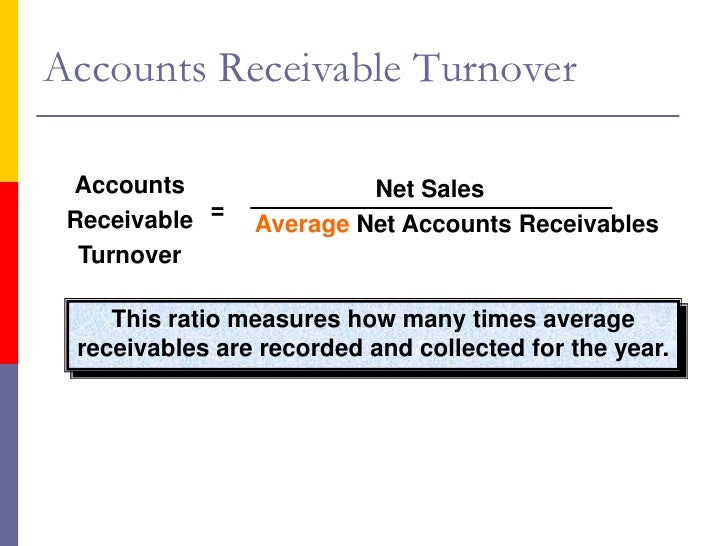

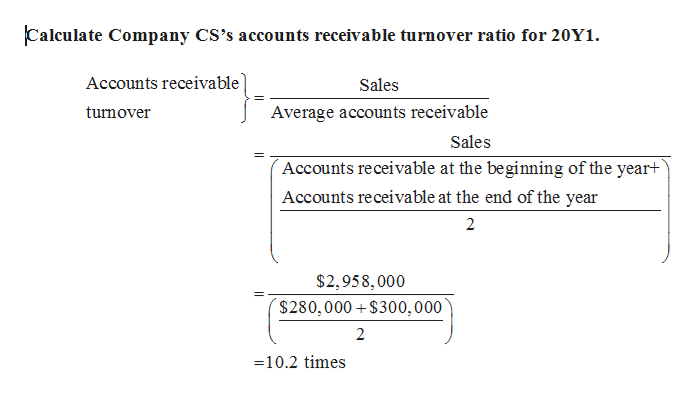

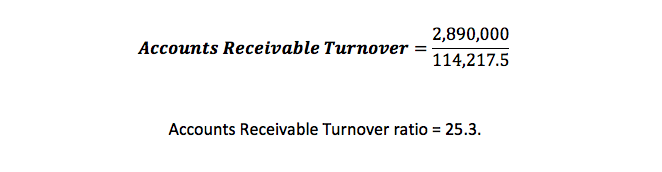

To calculate the accounts receivable turnover ratio for a company or department, you need to know the net credit sales and the average accounts receivable for the time you want to measure. Related: 18 Examples of Accounts Receivable Goals and Objectives What does the accounts receivable turnover ratio include? If the company's account receivable turnover ratio decreases over time, that might be a sign that the accounts receivable process at the company is becoming less effective since it takes longer for customers to pay for their purchases. Companies need revenue from credit purchases to operate, so it's important to collect accounts receivables at a steady pace. This ratio shows how efficient a company's accounts receivables department is at collecting unpaid money. Related: Q&A: What Is Accounts Receivable and How Does It Work? Why is the account receivable turnover ratio important? Accounts receivable is the amount of money that customers owe a company for products or services rendered.įor example, if a company had $50,000 of average receivables during a year and then collected $150,000 of receivables during the same timeframe, the business collected its average accounts receivables during that year. What is the accounts receivable turnover ratio?Īccounts receivable turnover is an efficiency ratio that measures the number of times a company can collect its average accounts receivables during a specific period, usually a year. In this article, we define the accounts receivable turnover ratio, explain the associated formula, list the steps for calculating accounts receivable turnover and provide you with an example to help you better understand the calculation. Learning more about this valuable metric can help you expand your understanding of financial management. If you work in the accounts receivable department of a company, you might use the accounts receivable turnover ratio to measure how effectively the department collects outstanding debt from customers who made purchases using credit. When analyzing financial ratios of several different but similar companies, a company can better understand whether it is an industry-leader or whether it is falling behind.Professionals use many metrics to evaluate how efficient their business or department is at collecting revenue. How it is performing compared to its competitors.When analyzing financial ratios of a single company over time, that company can better understand the trajectory of its accounts receivable turnover. Slower turnover of receivables may eventually lead to clients becoming insolvent and unable to pay. If a company's accounts receivable turnover ratio is low, this may be an indicator that a company is not reviewing the creditworthiness of its clients enough. How sufficiently a company is evaluating the credit of clients.A company can project what cash it will have on hand in the future when better understanding how quickly it will convert receivable balances to cash.

When it might be able to make large capital investments.Some lenders may use accounts receivable as collateral with strong historical accounts receivable activity, a company may have greater opportunities to borrow funds. What collateral opportunities a company may have.

As a company processes receivable balances faster, it gets its hand on capital faster.

0 kommentar(er)

0 kommentar(er)